Investment Philosophy

Te Ahumairangi rejects the hubris of many fund managers' philosophies which claim that markets are routinely inefficient and that this inefficiency can be simply exploited at all times using some unchanging algorithm or through simply trying to forecast company financials better than others.

...we should focus our efforts on using perspectives that are not being used by many other investors

We have more respect for investment markets than this. While we believe that there will always be some inefficiencies in market pricing, we believe that investment markets are close to efficiently priced in most respects most of the time.

This means that we should focus our efforts on using perspectives that are not being used by many other investors. It also means that we shouldn’t turn our noses up at small but relatively certain ways of adding value to the portfolio. We also take a diligent approach to protect investors against unnecessary costs (such as fund managers lazily investing in ETFs, which layer on extra fees and can create tax inefficiencies).

Understanding the natural flux of market inefficiency

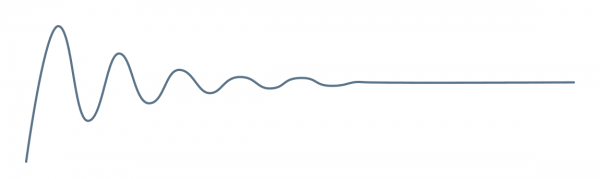

We believe that competition between investors and fund managers means that no single type of market inefficiency lasts forever, as money tends to flow into any investment approach that seems to work. This money-flow into strategies that seem to have added value means that many aspects of market pricing will tend to be efficiently priced at any point in time, and that investment characteristics that have helped to predict performance over the past several years will almost certainly be fully appreciated by many investors and fund managers, and therefore very unlikely to be routinely under-priced.

Favour investment characteristics that are under-appreciated by investors

In line with our understanding of how investor behaviours shape markets, we believe that a key to long-term investment success is to identify and favour meaningful investment characteristics that are under-appreciated by the majority of investors. We understand that finding these under-appreciated investment characteristics will often mean incorporating investment strategies that are out of favour with other investors.

There is a need for balanced judgement in assessing whether particular characteristics are being generally over- or under- appreciated by investors. When faced with uncertainty, we avoid jumping to conclusions and are happy to err towards assuming that the general market pricing for a particular characteristic is fair. We know that markets can trend in the same direction for a long time, which means that it is sometimes best to bide our time and wait until “bargain prices” have been further reduced.

This aspect of our philosophy means that in 2021, after investors have spent several years bidding higher and higher prices for rapidly growing companies, we find ourselves often favouring investments in companies that aren’t growing particularly fast, but whose ability to generate cash is under-appreciated by other investors. We suspect that at some point in the future we will invest in many growth companies after investors have got excited about something else.

We don’t turn our noses up at small-but-relatively certain ways of adding value

Our respect for the frequent near-efficiency of investment markets means that we love to find the exceptions – anomalies in market pricing which are clearly incorrect. For example, when two securities in the same company place different values on the same underlying cashflows, we will favour the cheaper security. Similarly, when a holding company trades at a significant discount to the value of the shares it owns in other listed companies, we will tend to favour shares in the holding company over shares in the subsidiaries.

Avoid unnecessary cost

We are very aware of how much value some other fund managers can destroy through unnecessary costs. These include: inefficient tax structures (such as buying foreign ETFs which incur taxes on foreign dividends, which cannot be offset against the tax obligations of NZ investors); excessive transactions costs caused by fund managers placing orders that represent large percentages of average daily volumes; washing all cashflows back to US dollars on a daily basis (such that they will cross foreign exchange spreads twice if they buy and sell securities in the same currency a couple of days apart); and paying unnecessarily high commission rates. At Te Ahumairangi, we will endeavour to do our best to minimise or avoid all of these costs, in addition to charging clients reasonable fees.

Maintaining a modest risk profile

We believe that investors and fund managers often under-appreciate the importance of risk, and a pursuit of higher returns often leads to funds and portfolios being skewed towards those companies that are likely to fall the hardest in the event of a market downturn. Because of this investor blindness to risk, there is strong evidence that low and medium risk equities have historically produced at least similar returns to higher risk equities. We try to always invest the majority of the funds we are responsible for in equities that have low to average risk, as we believe that this approach is likely to produce a better reward-for-risk ratio for our investors.