Why We Prefer Lower-Risk Equity Portfolios

At Te Ahumairangi, we aim to build equity portfolios that are predominantly invested in shares of low to average risk, and we try to only invest a relatively small proportion of funds into riskier shares that would be likely to fall harder than average if the market declines.

Important Disclaimer: The discussion on this web page is intended to explain why Te Ahumairangi Investment Management favours lower-risk equities for the portfolios it manages and does not constitute a recommendation or financial advice to any person. This web page discusses historical investment returns, which may not be indicative of future performance. This discussion was written in October 2021 and includes observations made at the time of writing which may not be so relevant on future dates.

While higher-risk asset classes (such as equities) have produced better returns over time than lower-risk asset classes (such as government bonds), there is no clear evidence that higher-risk equities have produced better returns over time than lower-risk equities

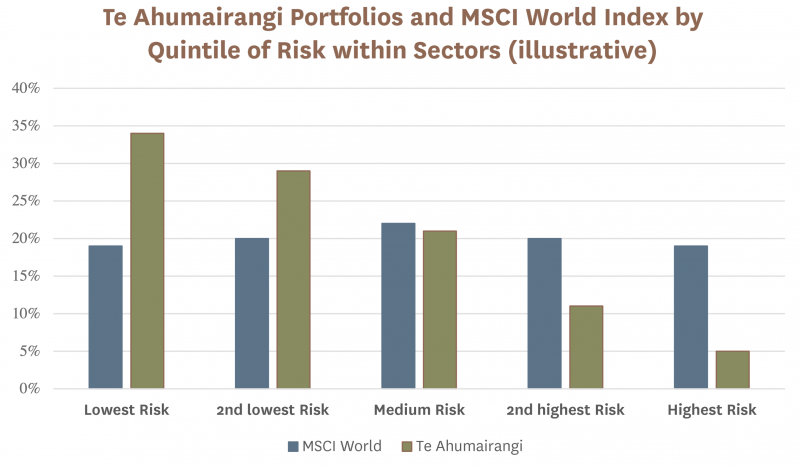

The graph below illustrates how we expect our portfolios to typically compare to the MSCI World index (a widely used benchmark that reflects the performance of developed country share markets). In this graph, you can see that our portfolios typically have a greater percentage of funds invested in lower-risk shares, and a relatively low percentage invested in higher-risk shares.

Why do we do this? A common assumption in finance theory is that return will be correlated to risk, implying that you need to take more risk to get higher returns.

However, the evidence suggests that the predictions of this theory are only partially correct. While higher-risk asset classes (such as equities) have produced better returns over time than lower-risk asset classes (such as government bonds), there is no clear evidence that higher-risk equities have produced better returns over time than lower-risk equities.

Higher-risk equities have failed to produce better returns

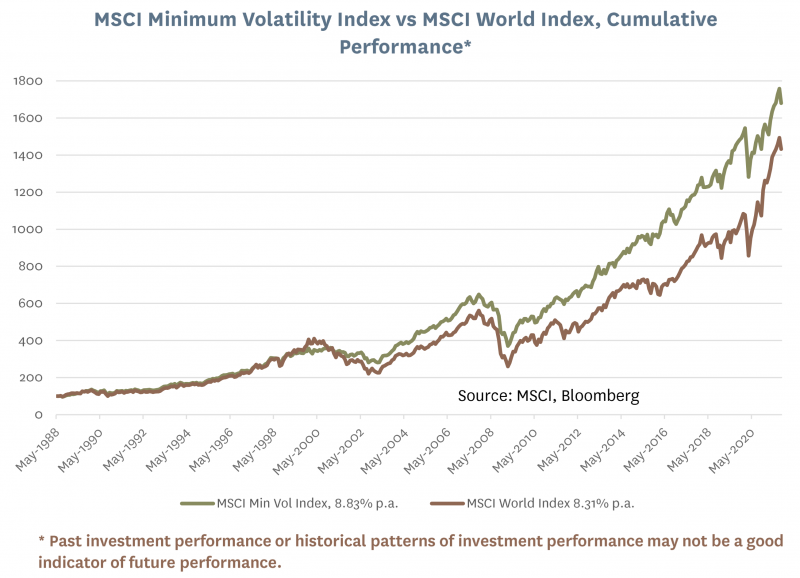

This can be seen by comparing the total return performance of the MSCI World Minimum Volatility Index to the total return performance of the MSCI World Index. The Minimum Volatility Index is designed to favour lower-risk stocks from within the MSCI World Index, so the fact that it has out-performed the MSCI World Index over the period shown in the graph below (which goes back as far as data is available) is a serious challenge to the belief that higher-risk stocks should produce better returns*.

In addition to having provided better returns over time, the MSCI Minimum Volatility index has reduced downside risk. The worst loss that an investor could have possibly experienced in the Minimum Volatility index over any time period since 1988 was -43%, which compares to a potential loss of -54% if they had invested in the MSCI World index.

Research finds no evidence that higher-risk equities compensate for risk

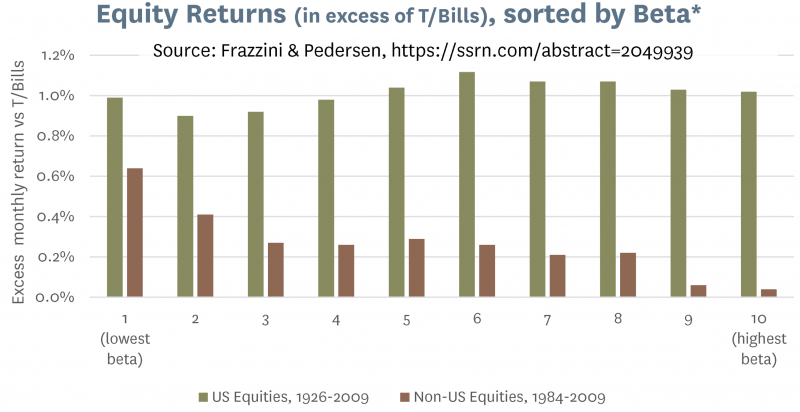

Academic studies also support the conclusion that risky stocks have not historically produced any better returns than lower-risk stocks. Specifically, empirical evidence suggests that there has been no clear positive historical relationship between how sensitive a stock is to market movements and its subsequent returns (see graph below).

* Beta is a measure of how sensitive a share price is to movements in the overall share market. Shares with relatively high betas show a tendency to move by more than the average stock in response to any significant rise or fall in the share market, whereas shares with relatively low betas have a tendency to show a more muted response to any movement in the share market. Past investment performance or historical patterns of investment performance may not be a good indicator of future performance.

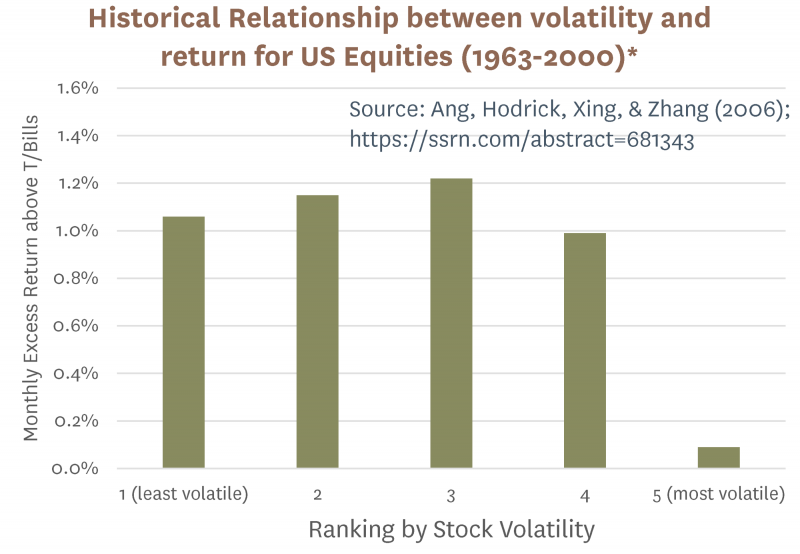

Further, the empirical evidence suggests that more volatile stocks have historically delivered worse returns than less volatile stocks:

Behavioural biases suggest that higher risk equities will continue to produce an inferior reward-for-risk

Looking forward, we believe that it is likely that risky and volatile equities will fail to deliver returns that properly compensate investors for their additional risk, just like they have in the past.

This is because we continue to observe behaviours which indicate that investors, fund managers, and other market participants in equity markets continue to under-appreciate the importance of downside protection. Many fund investors choose fund managers purely on the basis of returns (not risk), and fund managers know this. This causes some fund managers to simply try to pick the stocks that they think will generate the highest near-term returns, regardless of risk. But cognitive biases mean that when fund managers choose stocks mainly on the basis of expected returns, they are more likely to favour riskier stocks. We observe that many actively managed equity funds are skewed towards equities that are more volatile and more sensitive to market conditions than the average equity.

Timing can be important, and now (late 2021) seems like a reasonably good time to favour lower-risk equities

From time to time, investors do show more appreciation of the value of downside protection. When this happens, the pricing of defensive stocks can become more elevated relative to riskier stocks, which may temporarily sweep away the “free lunch” of similar returns for less risk from investing in lower-risk stocks. However, we believe that this normally happens after a period of disappointing returns from equity markets, and (as of October 2021) we do not currently see much evidence that equity markets are priced to deliver higher returns to investors in higher-risk stocks.

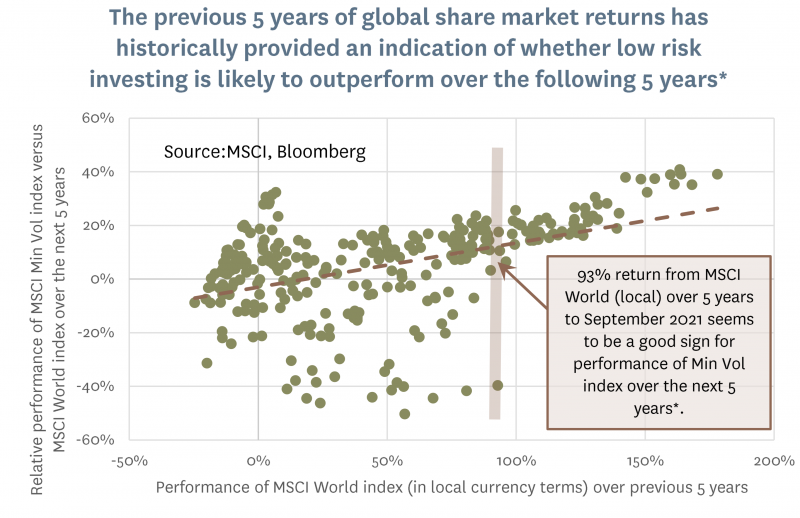

Historically, there has been a strong correlation between how strong the share market is over one five-year period and the extent by which low-risk stocks outperform the broader share market over the subsequent five year period. Based on this historical relationship, it currently (October 2021) seems like a reasonably good time to favour lower-risk equities.

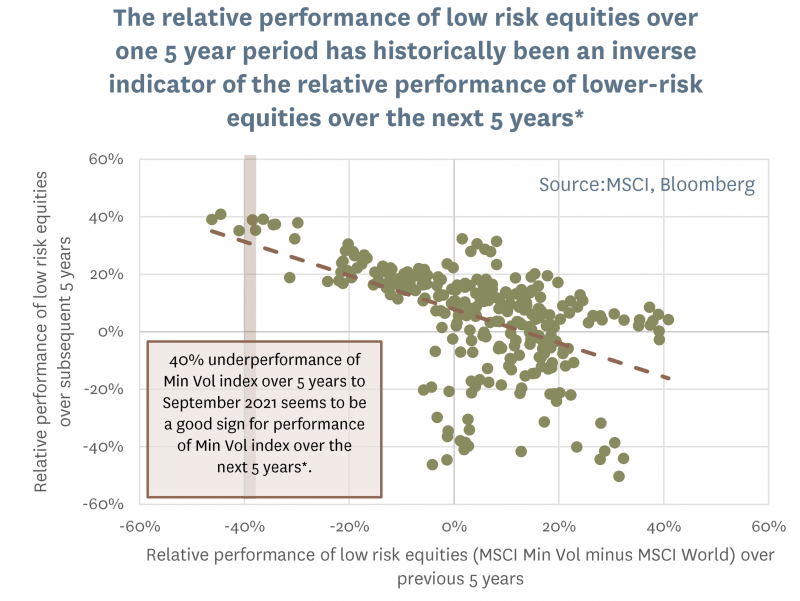

The historical record also suggests that it may be better to invest in lower-risk equities after they have gone through an extended period of underperforming the broader equity market. This historical relationship would also suggest that late 2021 is a relatively good time to start favouring lower-risk equities:

Te Ahumairangi prefers to tilt towards lower-risk stocks in most market environments, but the extent to which we favour lower-risk stocks will depend in part on whether we believe the market environment and pricing of lower-risk stocks is supportive of relatively good future returns.

* Past investment performance or historical patterns of investment performance may not be a good indicator of future performance.