Tesla is Extremely Over-Valued

NBR Articles, published 21 January 2025

This article, by Te Ahumairangi Chief Investment Officer Nicholas Bagnall,

originally appeared in the NBR on 21 January 2025.

Tesla has a market capitalisation of US$1.37 trillion, making it the eighth most highly-valued company in the world (behind Apple, Nvidia, Microsoft, Alphabet, Amazon, Saudi Aramco, and Meta). This represents a multiple of over 100 times the earnings that Tesla has reported over the past year (or a multiple of about 200 times if you exclude “earnings” relating to the one-off recognition of deferred tax credits).

Tesla is a favourite on share-trading platforms…

A lot of people have a lot of money invested in Tesla. Sharesies’ website reveals that it is the second most-owned stock on the Sharesies platform (behind Air New Zealand). Hatch’s website lists Tesla as the second “most-traded” stock on the Hatch platform (behind Nvidia). In the United States, Robinhood (the US equivalent of Sharesies & Hatch) disclose that more of their clients are invested in Tesla than any other stock.

Passive investors also have a lot of money invested in Tesla. If you’re using an index fund to obtain exposure to global equities, it is likely that somewhere between 1.3% and 2.4% of your global equity exposure is invested in Tesla.

… but not such a favourite with Active Fund Managers

While amateur investors and passive investors hold a lot of Tesla, it is rare to see Tesla listed amongst the top-10 holdings of professionally-managed active funds dedicated to global or US equities.

In a sense this is to be expected. Tesla represents about 1.33% of the free-float capitalisation of global equity markets. If we guess that retail investors have an average of (say) 3% of their funds invested in Tesla and that passive funds have 1.5% of their funds invested in the company, then the only way that Tesla’s share register can balance out is if active fund managers are significantly under-represented on that share register (investing something like 1% of their total equity funds in the company).

Are retail investors right to be piling into Tesla?

Implicitly we’re seeing a strong difference of opinion between “retail punters” and active fund managers with respect to Tesla’s investment attractiveness.

Retail investors may sometimes intuitively understand the potential of a company’s product offering before this is fully apparent to professional fund managers. Arguably, this was the case when retail investors first embraced Tesla several years ago.

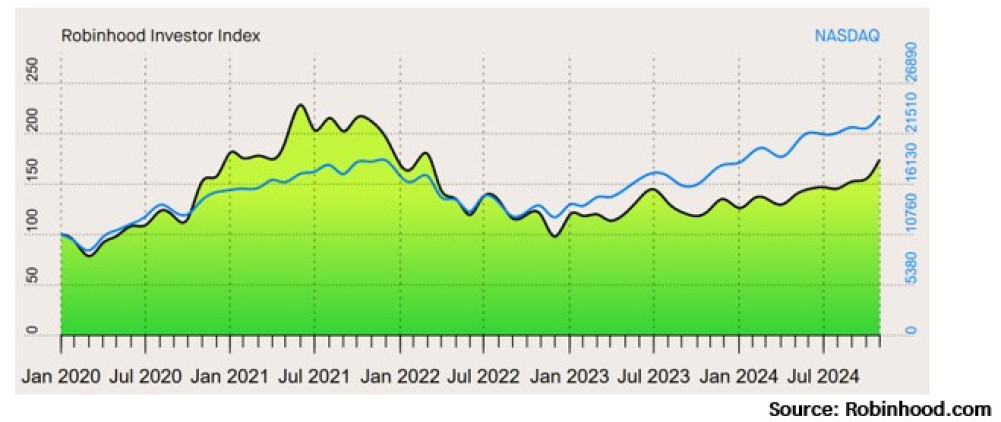

However, history does not suggest that siding with retail punters is generally a good idea. The Robinhood share trading platform in the United States publishes an index tracking the performance of the 100-most-held stocks on their platform, and as the following screenshot from Robinhood’s website indicates, their investors (represented by the green area on the chart) have significantly lagged the US share market (using the Nasdaq composite index, represented by the blue line) over the past 5 years. It can also be seen from this graph that the companies held by retail investors on the Robinhood platform have tended to be particularly sensitive to market conditions, often rising faster than the market during bull markets, but falling harder during bear markets.

However, active fund managers also have a less-than-stellar track record. For example, S&P’s SPIVA survey shows that 77% of large-cap US equity funds under-performed the S&P 500 index on a net-of-fees basis over the 5 years to June 2024.

In the remainder of this article, I’ll take a look at the prospective long-run returns from Tesla, and try to see whether it is possible retail investors’ large allocations to Tesla could be justified.

As is my inclination, I’ll be evaluating Tesla by looking at the long-run returns it may reasonably be expected to deliver to investors who hold it for the long-run. However, whenever possible, I will tilt the analysis slightly in favour of Tesla, to try to avoid confirmation bias. (As you will see in the disclosure at the end of column, we don’t hold any investment in Tesla).

Long-term returns from Tesla must come from growth, not dividends

If you hold an equity investment forever, the only return you’ll get from it will be the dividends and capital returns that the company distributes to shareholders. But if you consider an equity investment over a shorter “long-term” period of 10 to 20 years, the return will come from a combination of share price growth and cashflow from dividends.

For many companies, share price growth and cashflow to shareholders are similarly important sources of return over time periods of 10 to 20 years.

However, this is not the case for Tesla. As Tesla’s current profitability represents a return of less than a 1% return on its market value, dividends are not going to represent a significant source of return, and the key to understanding future returns from Tesla is to consider how its profits and market value could change over the next one to two decades.

What growth can we reasonably expect in Tesla’s revenues?

To evaluate what Tesla may be worth in the future, we will first look at how Tesla’s revenues may evolve over the next 15 years.

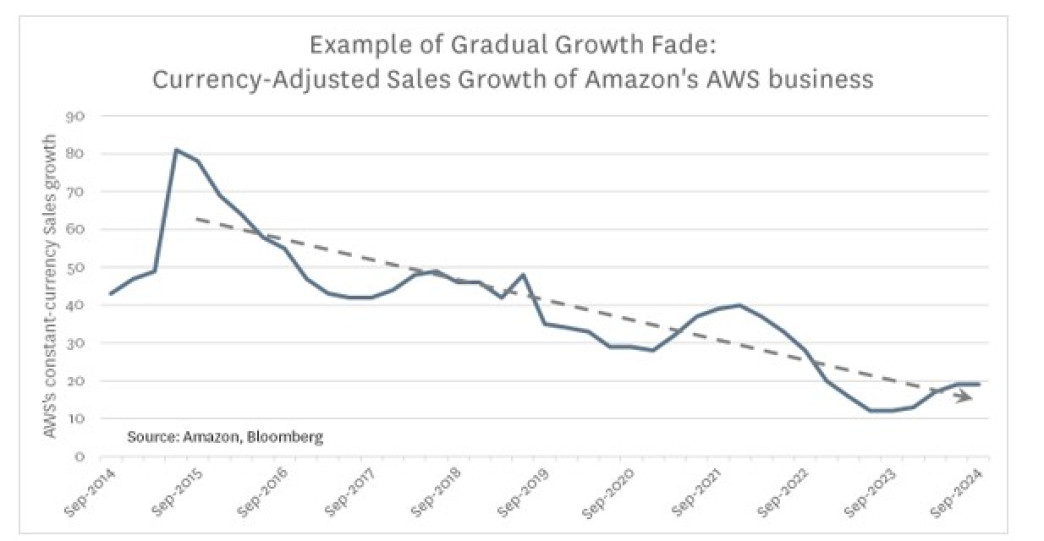

A starting point for forecasting the future sales trajectory of a growth company will often be to extrapolate based on recent growth trends, and to assume a gradual slowing in growth rates over time. For example, consider the following graph showing constant-currency revenue growth from Amazon’s “AWS” cloud services business. Looking at this graph, we can see that percentage growth rates in AWS’s revenues have gradually slowed down over time, such that a reasonably starting point for forecasting AWS’s growth has generally been to assume that it would grow slightly slower over the next year than it has over the past year, and that this growth rate would slow down a little bit further over the subsequent year, and so-on.

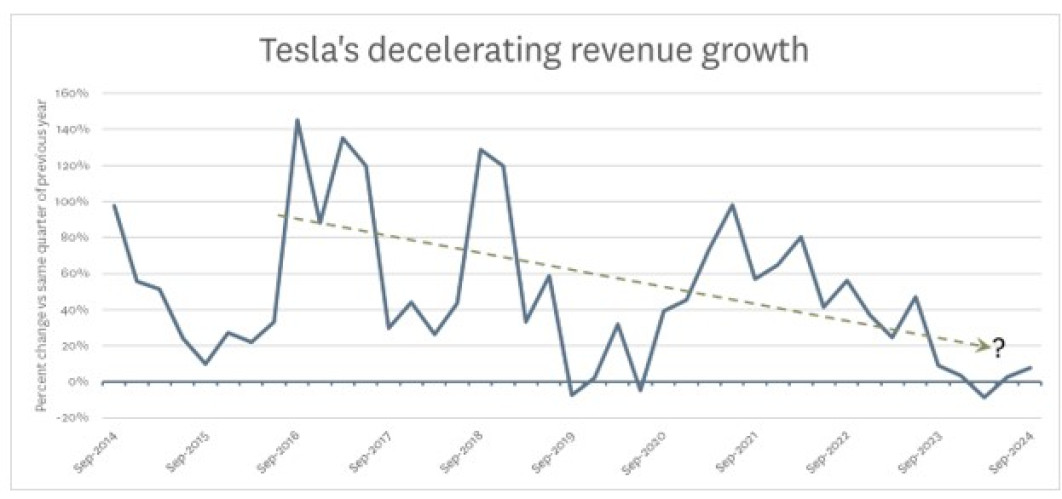

Unfortunately for Tesla investors, there has already been a marked slow-down in Tesla’s growth rate. Tesla’s revenues from selling automobiles only increased by 1% between the September quarter of 2023 and the September quarter of 2024, with total revenues growing +7.8% due mainly to growth in regulatory credits, energy generation, and maintenance services. Sell-side analysts estimate that revenue growth rates have been similar in the December quarter.

As the graph below shows, Tesla’s revenues had been volatile in the early years (when Tesla’s revenues were less than one tenth of the levels being achieved by large car-markers like Toyota or Volkswagen). However, Tesla’s sales settled into a pattern of more consistent growth between 2020 and 2023.

The slowdown in 2024 seems concerning. Can we disregard the weakness in 2024, given the past volatility in Tesla’s revenue growth?

This slow-down in growth would not be a big concern if it reflected economic/market conditions, and Tesla had been growing its market share in a declining market. However, this has not been the case. Global sales of electric vehicles (including plug-in hybrids) are estimated to have risen by 25% in 2024, to over 17 million vehicles, yet Tesla has reported a -0.6% decline in vehicle sales to 1.79 million.

If we conclude that Tesla has gone ex-growth, it would be impossible to avoid the conclusion that Tesla shares would be a particularly lousy investment at current prices, as the share market is valuing it on an enterprise-value-to-revenue multiple that is about 70 times as high as the market valuation of other car companies (e.g. Volkswagen, Stellantis) that are also showing no revenue growth.

Looking on the bright side of life…

Rather than focussing on the potential downside scenario if Tesla has stopped growing, the intent of this column is to explore whether there is some way that Tesla’s share market valuation could be supported by its future growth prospects. I will therefore assume that the decline is Tesla’s sales over the past year was just a temporary pause in its growth and look at how large Tesla could conceivably get if it resumes its previous growth trend.

Globally, it is estimated that slightly over 88 million light vehicles were sold in 2024. Of this total, maybe 11.5 million (13%) are fully electric (a.k.a. BEVs, short for Battery Electric Vehicles) and about another 5.5 million are plug-in hybrids.

The global automotive market is intrinsically fragmented, due to low barriers to entry. The largest company, Toyota, holds an 11.5% market share of vehicles sold, and Volkswagen (second largest) has just over 10%.

Market shares are slightly more concentrated in the BEV segment of the market, with Tesla and BYD each holding market shares of slightly over 15%. However, many of the traditional automotive manufacturers (which were generally late to embrace EVs) are rapidly growing their share of the BEV market.

A starting point for a bull case on Tesla would be to assume that over the next 15 years or so, BEVs will largely replace traditional internal combustion and hybrid vehicles, such that maybe 90% of vehicles sold in 2040 will be BEVs. Under this scenario, we might assume that 100 million BEVs are sold each year by 2040 (out of a global automobile market which could be 111 million cars per annum in 2040). If we also assume that Tesla stops losing share of the BEV market, and retains its 15% market share, it could conceivably be selling 15 million vehicles each year by 2040, which would make it significantly larger than any automotive manufacturer today.

Autonomous driving

Tesla has another trick up its sleeve – it has invested significantly in autonomous driving, which could well begin to dominate the car market within 15 years. Self-driving “robo-taxis” could conceivably replace car ownership for many people, as robo-taxi services are likely to ultimately be priced to get people from A to B at about half the price that it costs with a human driver on Uber (due to the absence of any need to pay a driver).

Alphabet’s Waymo subsidiary seems to leading the development of robo-taxi services, having clocked up way mo’ (excuse the pun) miles of autonomous driving experience than any other company. However, Tesla is arguably the second most advanced company in the development of self-driving technology, now that GM’s Cruise subsidiary has lowered its ambitions to just focus on the development of driver assistance technologies (rather than full robo-taxi services). Tesla does not lower its ambitions: for the past 4 years, Elon Musk has been telling investors that it is about a year away from offering fully-autonomous driving!

I think it is inevitable that there will end up being multiple companies that can provide autonomous driving technology. However, there must be a strong likelihood that there will be a period of time when the only vehicles licensed to operate robo-taxi services in many parts of the world will be using technology from either Waymo or Tesla. This could be an opportunity for Tesla to increase its market share.

The business model that Tesla has talked about is selling vehicles to people who would operate small fleets of autonomous vehicles under the umbrella of a service such as Uber. Under this business model, autonomous driving would end up being a feature that would help Tesla sell more vehicles and maybe make a higher margin on each vehicle.

As an upside scenario for Tesla, I am going to assume that sales of robo-taxis could further increase its market share to 22% of electric vehicles (i.e. 20% of all vehicles) by 2040, representing annual sales of 22 million cars (more than twice as many cars as any company sells today). No car-maker has achieved this sort of market share since the days of Henry Ford, but an extraordinary share market valuation demands that we consider extraordinary scenarios, so let’s work with this.

What could sales of 22 million cars mean for Tesla’s future revenues? I estimate that this scenario could lift Tesla’s revenues to US$1.2 trillion by 2040, which would make Tesla roughly 4 times as large as Toyota is today, and bigger (in revenue terms) than any company in the world today. For Tesla to do this would be an extraordinary feat, representing 12-fold revenue growth, or 16.8% per annum.

What future profits might Tesla achieve?

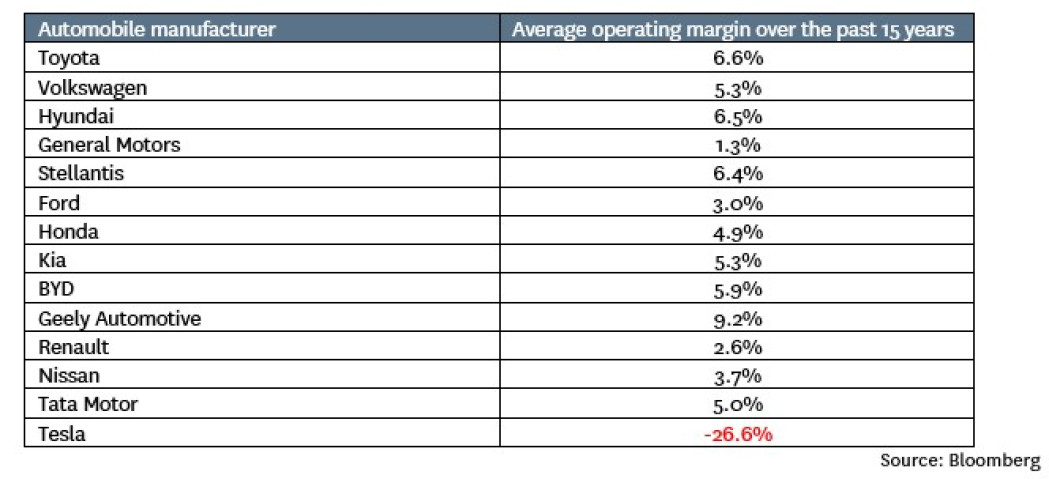

Unfortunately for Tesla, selling cars to the mass market is not an intrinsically high-margin business. Cars require a lot of expensive materials (including battery materials in the case of EVs), and represent an expensive outlay for most buyers, meaning that they shop around for the best deal. These factors limit the potential for auto-makers to get away with high margins.

Accordingly, operating margins in the mass-market automotive industry tend to be firmly in the single-digits, as you can see in the table below:

Many of the operating margins shown in the table above are boosted by finance operations, which tend to have higher operating margins than automotive manufacturing. Finance operations (typically lending money to car-buyers and car-dealers) require substantial capital investment, and Tesla has not deployed any significant capital into building a finance operation.

So, what operating margin should we assume that Tesla might be achieving in 2040? While this table would suggest that something of the order of 5% might be likely, let’s continue the pattern of bending over backwards to support a Tesla bull case, and assume that Tesla will achieve 10% operating margins every year from 2025 to 2040.

Under this scenario, Tesla would generate operating profits of US$120 billion in 2040, which I estimate will translate into a profit after tax of US$91 billion.

What does this mean for shareholder returns?

Tesla is remarkably capital-efficient for an automotive manufacturer, and for this reason, my modelling suggests that it should be able to fund the remarkable growth trajectory we are assuming entirely out of profits, and still have cash left over to return to shareholders. Under our bullish scenario for Tesla’s outlook, I assume it will generate average profits of US$39 billion per annum over the next 15 years, but only need to invest an average of US$23 billion per annum in growing its business. I assume that it returns capital to shareholders (through dividends or buybacks) at an average rate of US$18 billion per annum over the next 15 years.

However, due to Tesla’s extraordinary beginning valuation, these cashflows to shareholders will only contribute about 1% towards investment returns. To get a fair return for investors, the value of Tesla would have to increase significantly from the current starting point of US$1.37 trillion.

So what might Tesla be worth in 15 years’ time, at the start of 2040? Most large automotive manufacturers are currently being valued by the share market on multiples of less than 10 times tax-paid earnings. If we apply a P/E multiple of 10 to Tesla in 2040, this would imply a future value of US$916 billion, about a third less than Tesla is currently valued today. Under this scenario, the internal rate of return to investors in Tesla would be -1% per annum over the next 15 years.

But what if future investors (in 2040) expect Tesla to keep on growing beyond 2040, when it will have already achieved a higher market share than any automotive company has achieved in over a century? Maybe investors in 2040 will value Tesla at 25 times expected earnings (US$2.3 trillion)? Even in that scenario, the return you would get over 15 years from investing in Tesla shares would be just 4.4% per annum, lower than the (far safer) return you could earn on a US government bond.

What would Tesla have to be worth in 2040 to deliver a fair return to shareholders?

Tesla stock adds an unusually high level of risk to a portfolio. As can be seen in the graph below, when the share market falls, Tesla typically falls more than twice as much. In theory, this means that investors should require a risk premium from Tesla stock that is about twice as high as they would demand a typical stock. US government bonds currently yield about 4.7%, and I would suggest that investors should look for a risk premium of at least 3% per annum from the average stock. To my mind, this means that a required return from Tesla stock should be at least 10% per annum.

What future Tesla valuation would be needed to generate a return of 10% per annum? By my calculations, Tesla would have to be worth US$5.2 trillion by 2040 to generate a return of 10% per annum for Tesla shareholders. Even using the bullish scenario I have constructed for Tesla’s future profitability, this would require that the share market values Tesla at 57 times estimated current year earnings in 2040, by which time Tesla would have already grown its market share to point from which future market share gains would seem improbable.

What about robots?

Tesla have developed the “Optimus” humanoid robot, and are talking about the potential to sell tens of millions of these robots in the future. Optimism about Optimus could be a factor driving the share price of Tesla that is not captured in my modelling of future automobile profitability.

Robotics experts have been impressed with how fast Tesla had initially developed the prototypes for the Optimus robot, but haven’t see Tesla doing anything with this robot that hadn’t been done before. In fact, it was not clear that Tesla’s Optimus had much functionality that had not been present in Honda’s Asimo robot, released over 20 years ago, but Honda have never sold Asimo into the mass market, because they haven’t figured out how to ensure that it will never topple over on to a small child. Other companies (such as Hyundai’s Boston Robotics) seem to be more advanced than Tesla in the development of novel robotics.

While there is a chance that Tesla may achieve significant revenues and profits from selling humanoid robots in the future, there also a significant probability that they pour a lot of money into this and never develop a product that can be sold in volume at above its manufacturing cost.

Conclusion

In this column, I have tried my best to construct a credible scenario whereby an investment in Tesla shares might deliver a fair return to shareholders. I’m sorry, but I’ve failed.

If you hold an investment in Tesla, whether it might be through a share trading platform like Sharesies of through a passive investment fund, you might like to think more deeply about why you hold this investment.

Nicholas Bagnall is chief investment officer of Te Ahumairangi Investment Management

Disclaimer: This article is for informational purposes only and is not, nor should be construed as, investment advice for any person. The writer is a director and shareholder of Te Ahumairangi Investment Management Limited, and an investor in the Te Ahumairangi Global Equity Fund. Te Ahumairangi manages client portfolios (including the Te Ahumairangi Global Equity Fund) that invest in global equity markets. These portfolios don’t hold shares in Tesla, but hold shares in the following companies mentioned in this column: Amazon, Alphabet, Stellantis, General Motors, Apple, Microsoft, and Meta.